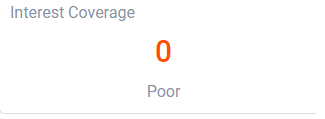

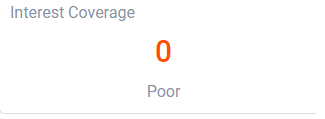

Interest Coverage Ratio

Helps You Identify If

- Your Business Is Able To Service Its Debts

- Your Debt Levels Relative To Your Sales Levels Are Changing

- Your Sales Levels Are Changing

Liquidity is a means of understanding a company’s susceptibility to either current of future financial distress. It also helps build a risk profile of the business. But remember though that a single “safe” liquidity measure does not exist across all industries. Likewise, some industries traditionally and successfully trade at low liquidity levels, whereas for others, the same figure is a sign of distress. One indicator of liquidity is understanding your company’s ability to cover its debt servicing. But, what is my interest coverage?

How do you get your finance coverage ratio? Your ratio is the amount of times that finance interest is covered by net operating income plus depreciation (ie free cash)

The measures indicates your ability to cover your debt and financing charges within your business. The lower the coverage, the greater risk there is in the business and your ability to cover your interest charges from your business. Check your interest coverage with Jazoodle now.

Definition used:

Your company’s interest coverage is calculated by the following:

Net operating Income + Depreciation

Divided by

Finance Costs

Your ratio can be improved by a number of measures or changes, including:

- Increase sales revenues

- or Reduce short term debt

- or Reduce long term debt

- Pay off credit cards