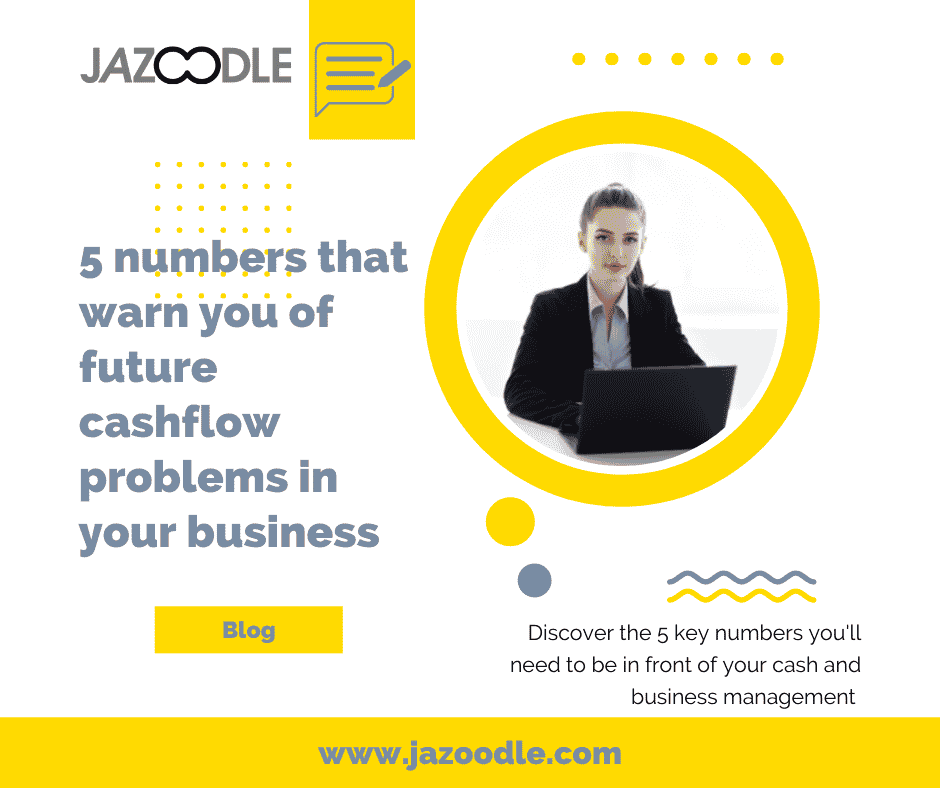

What are the 5 business numbers that warn you of future cashflow problems?

What are the 5 business numbers that warn you of future cashflow problems? Many businesses have been in this situation – sales are great, there’s money in the bank, and yet, 6 months later, you’re struggling to finance your operations despite record sales within your business.

The trouble is, you neither have the time, nor the inclination to pore over every financial statement you have, nor run countless reports in trying to identify any potential problems in your business. You may have a CFO or finance team in place, but how much time does this reporting take your team each month ?

So, whether you re a micro business with less than 3 employees, or a larger SME – here’s a real time and maybe business saver tip for you. We’ll explore the 5 key numbers that will highlight whether your business is storing up future cashflow issues. The great thing is, you don’t need to configure multiple reports nor run through line by line of your financial statements

Here are the 5 critical numbers

We’ll list these 5 numbers here, and then give some tips how you can use them

- Average receivables days – how long does your business take to collect your client invoice amounts?

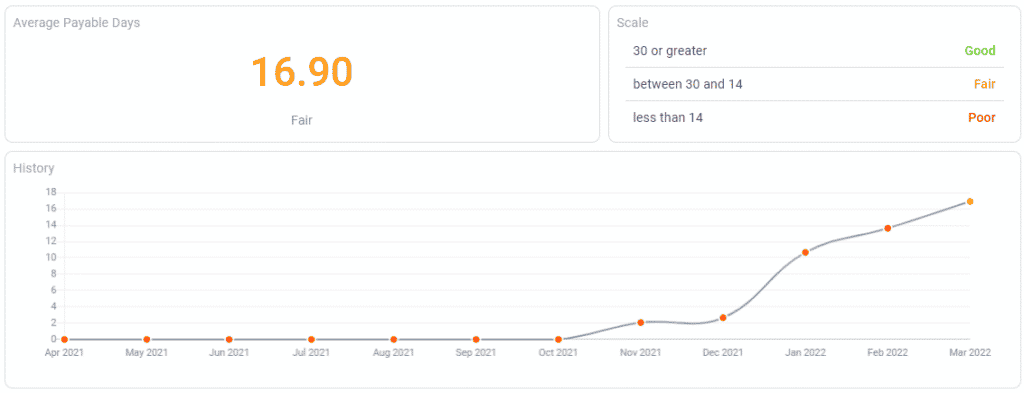

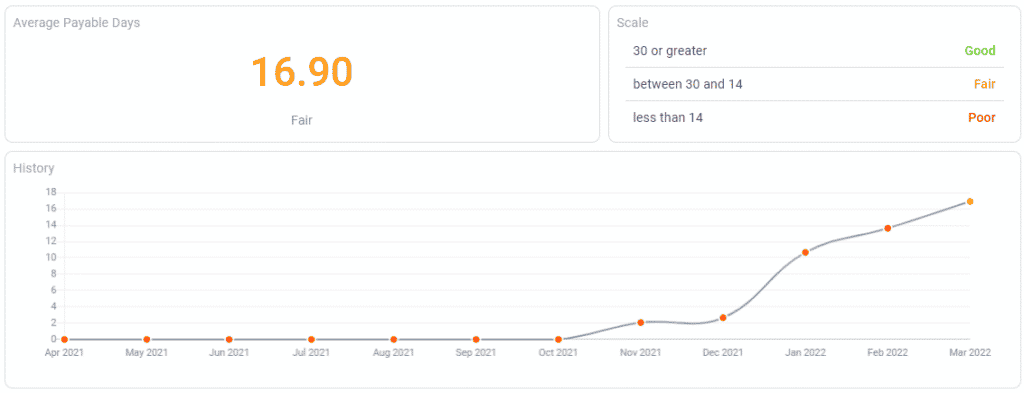

- Average payables days – how long do you take to pay your suppliers?

- Average inventory days – are you holding too much inventory

- Monthly cash burn rate – how much cash do you burn on a monthly basis

- Cash Runway – Given this, if all sales stopped tomorrow – how long could your business survive before going into negative cash territory – what is your cash buffer in months..?

Individually they give good indications of potential problems, but together – they have super powers for business owners and finance teams. Let us give you a couple of finance hacks:

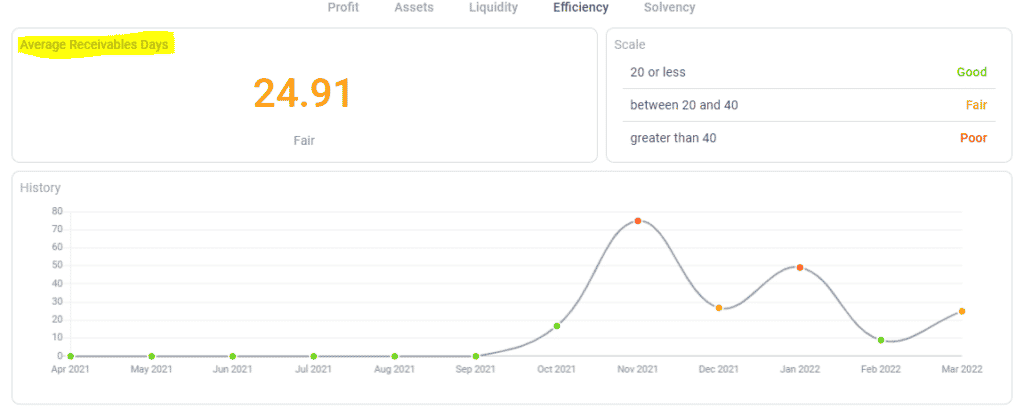

First up – what is your average receivables days figure? Ensure that your client invoice collections are efficient and trending downwards or static. Do you have a strong client collections policy. For instance, your policy could be a maximum 14 days for your receivables. Is your current number within that policy? If not, is it trending up, down, or static?

Next – assess your supplier payment days – again, is this within your policy? More importantly, you should aim for the average receivables figure to be less than the average payables figure. If not, you are paying out faster than you are receiving in and could indicate an issue in the coming months.

If all OK – check your inventory period – this tells you how long, on average, your stock takes to sell. So, for good cash positive numbers, you want:

Receivables Days < Payables Days and Inventory Days < Payables Days.

And here’s a little secret. the above is called your CASH CONVERSION CYCLE. A little number you can work out yourself and you should aim for it to be as low as possible. The lower the number, the lower amount of days it takes to fully cycle your cash and even can mean that, if negative, you are receiving cash into your business quicker than you are having to pay it out! Win Win

So, aim for a negative cash conversion cycle number.

Calc: Average Inventory Days + Average Receivables Days – Average Payables Days

In the below example:

The Cash Conversion Cycle is 56.44 + 30.24 – 38.15 = 48.53. THUS there is a gap of 48 1/2 days between a company spending its money and receiving its money back.

Monthly Cash Burn Rate And Cash Runway

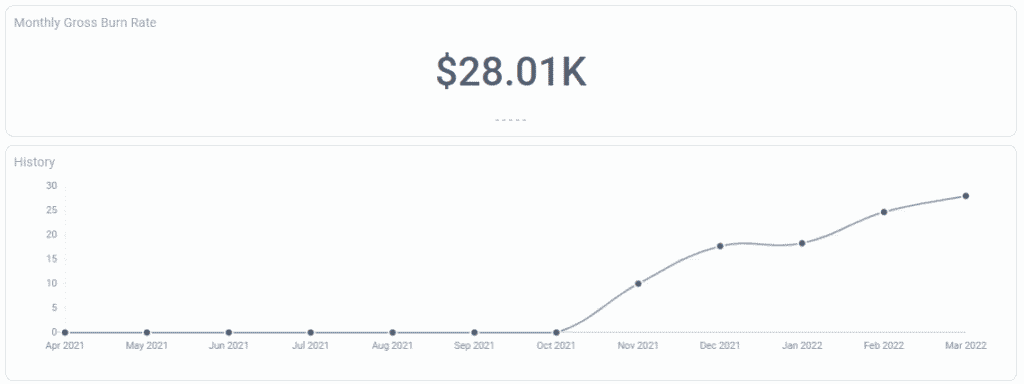

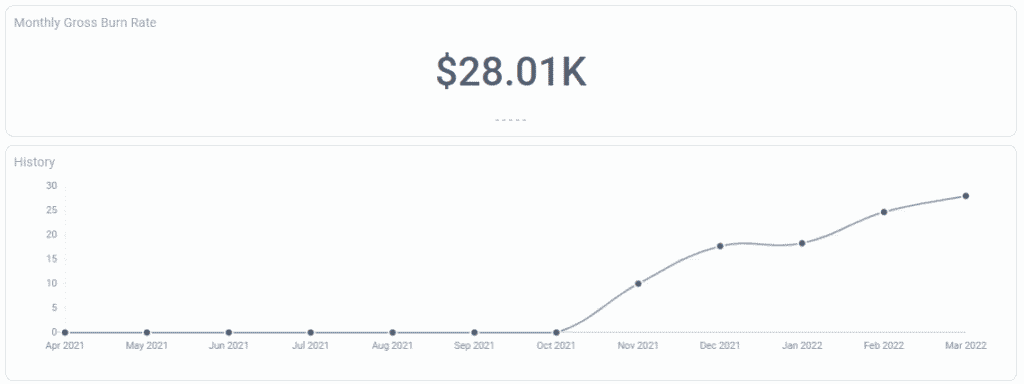

Now – what about your general overheads…? Jazoodle allows you in seconds to assess what your average monthly cash burn rate is. Assess over monthly, quarterly, 6 monthly, and annual views. Your annual view may look fine, but you could find that our expenditure is trending up unsustainably over the past 6 months. A good early indicator.

Finally – Covid has shown many businesses the importance of understanding a business’ cash runway. What we mean by this is for how many months is your business cash positive if all incomes stopped today. You may think this is far fetched, but what about floods / fire and other natural weather events that may put a stop to your business? You should aim for a minimum runway of 3 months and preferably 6 months should such an occurrence appear.

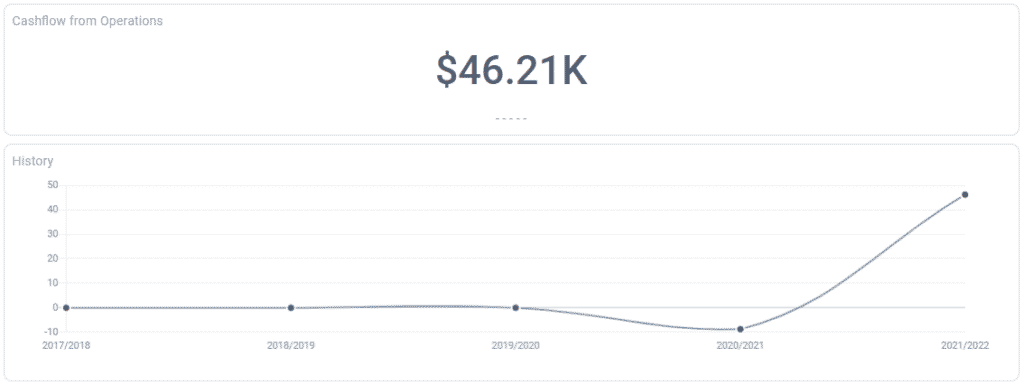

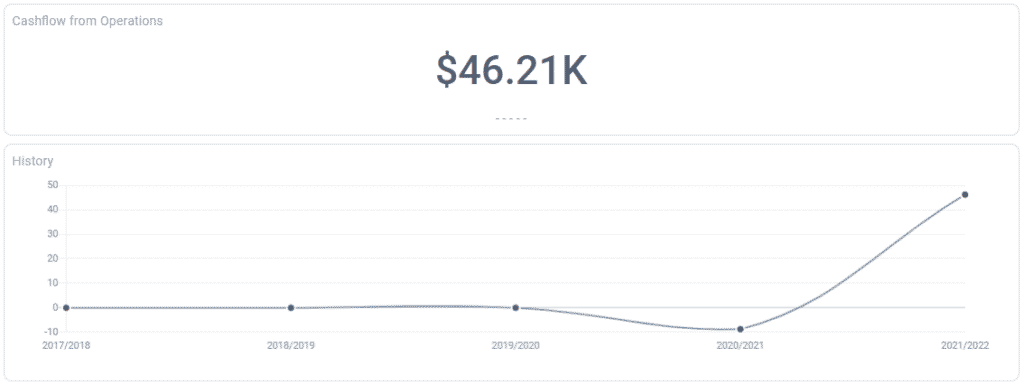

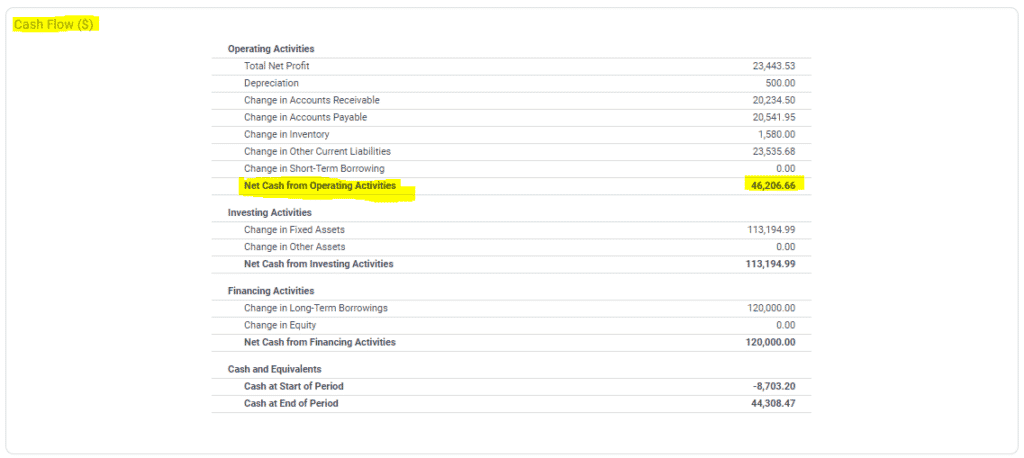

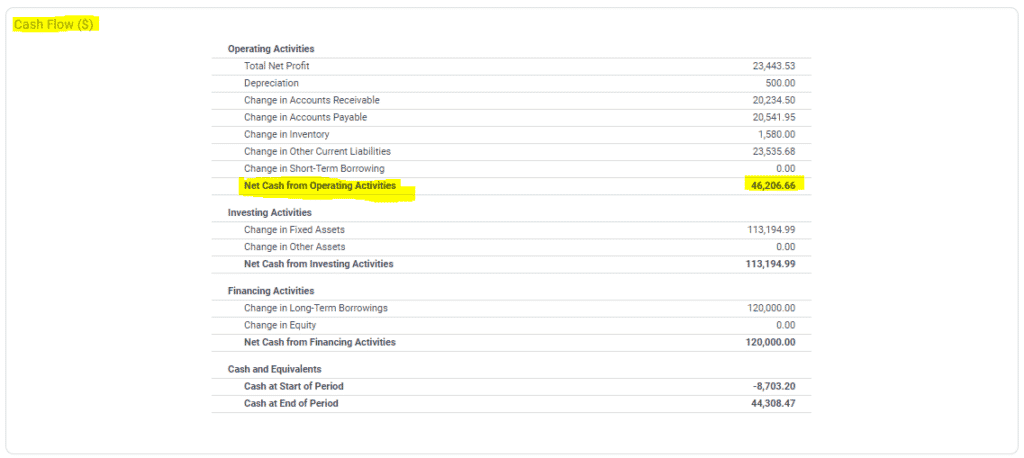

Cash Generated From Normal Operations

We mentioned 5 key numbers. There is also a 6th. How much cash is your business generating from normal operations? Assess this either in your statement of cashflows within Jazoodle, or within the KPI area. Ensure that the generation of cash from operations is at least steady over time, or increasing. Watch out for falling numbers here, and increasing cash from things like asset sales.

One of the things that we mentioned earlier, was the importance of understanding trends within your business. Each cash indicator should be assessed also based upon its trends. Jazoodle’s graphs of each of the 5 can be accessed simply by clicking on the relevant number and the graph printed out if needed.

Summary

If you are looking for a very quick, almost up to date (within 24 hours) and very simple view of these 5 key numbers, you can also view on the fly, on your smartphone.

Jazoodle takes the pain out of some of the number crunching within your business and presents them in a very easy to understand way. Integration with your accounts package, such as Xero, QuickBooks Online, and MYOB takes less than a minute, but could save you days of stress and essential time to plan your way out of any future cash issues either by yourself or in consultation with your accountant or trusted business advisor.