Inflationary Pressure – How This May Affect Business

Forward

Earlier this year, we wrote an article about business complacency and testing your business’ resiliency as we looked to exit the global Covid19 pandemic. One of the areas of concern, following pandemic recovery, was significant pressures foreseen in the global economy, beautifully argued by Charles Goodhart, Manoj Pradhan (2020). As we head into the tail end of the year, we see some of these inflationary pressures building in a number of western countries. Why is inflation so bad for both individuals and businesses? What can you do as a business or advisor to businesses to best prepare them for times of potentially higher inflation globally?

Inflationary Pressures – The Background

Inflation can be caused by a number of factors. We will delve into these shortly. First up, what is inflation? According to The International Monetary Fund , inflation is “ the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country.” Inflation causes countries to become unstable, cause political unrest, and hurts all of society, particularly workers, who can in the instance of non wage inflation, see the cost of goods rise more than the rise in their wages. In recent years, and with the tendency for central banks to control monetary policy (which is often seen as the primary inflation control measure), many economies have enjoyed a sustained period of low inflation, and therefore the stability of their economies. Central Banks will generally set a “Goldilocks” range for inflation (often between 2 and 3.5 % pa) and adjust interest rates accordingly to either stifle or stimulate economic activity. The reasoning being, if inflation starts edging upwards, and therefore threatening economic stability, then a central bank can adjust interest rates upwards, to stifle disposable income, and therefore economic growth just enough to put a lid on prices rising upward at an unsustainable rate.

The problems with Inflation

High long term inflation hurts both individuals and businesses alike. Your costs of inputs (such as direct products and labour) may rise, eroding your gross profit margins. As well as this, it is likely that your overheads would also rise. Think about the costs you incur such as electricity, and gas for instance. Upward pressures are being seen here globally too, as we transition to a renewable energy market, or the wind doesn’t blow for instance. Office supplies, marketing costs will also affect you, eating into your net profitability.

For individuals, inflation means that the real value of money is also decreasing. What do we mean by real value of money? Let’s think back to say 1970. The cost of a loaf of bread would have been around 21 cents in Australia. Today, a loaf of bread will set you back say $2.50 per loaf. So, 21 cents in 1970 would buy you about 8 ½ percent of a loaf today.

How Does Inflation Diminish The Real Value Of Money?

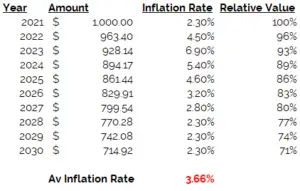

Here’s an example of the diminishing rate of money due to inflation. The first example shows what happens to $1000 of today’s money if you left it under the bed for 9 years with an average inflation rate of 3.66% between now and 2030.

Scenario 1 – Short Lived Inflation

So, your $1000 would still be physically $1000, but with inflation, it’s purchasing power in 2030 would reduce to $714 – ie it has effectively lost around 29% of its value in those 9 years.

Scenario 2 – Longer / Higher Inflation

Now, suppose inflation was higher, and lasted longer than the previous example. Inflation has really taken its toll, and your $1000 today would be only worth $623 in 2030, a reduction of 38%. That is effectively an increase in inflation of around 1.6 percentage points on average

The effect is dramatic and when coupled with your business’ key indicators and a rise in both your cost of goods and expenses, both your gross AND your net margins are put under pressure. You can measure your margins and track them over time with our dashboard.

So what does this mean in terms of steps you can take to protect your business during times of inflationary pressures..?

Analysing Inflationary Effects On A Business

To understand this, we’ll analyse through the lens of your financial statements:

Profit and Loss Statement

Income statements are made up of, (simply put), revenues, costs of goods (products or services), and general expenses, as well as other non operating income, expenses, and accounting treatments:

Revenues

Less

Cost Of Goods

Equals

Gross Profit

Less

Expenses

Equals

Net Profit

Revenues

Revenue increases will depend upon how elastic your product or service’s demand is. Do you sell luxury, discretionary or nice to have products? With an example inflation rate of 5.5% average PA, can you raise your sales prices by 5.5%. The more discretionary your product or service is, the greater the likelihood, you will not be able to raise price by inflation amounts. Equally, are you operating in a highly commoditised, competitive market. Again, you may not have the full price levers at your disposal.

So, suppose we have two products, Product A and Product B. Both have different demand lines. At a price of $100, we would expect to sell 10 units of product A, but comparing, product B would only likely sell 1 unit.

Product A

Product B

Looking at this further, under normal conditions, and at a price of $30, each product would expect to sell around 80 units. Now suppose if you had to increase price by $10 to counter inflationary pressures of your cost of each unit. Product A’s company would see a drop of around 10 units sold, whereas with Product B, a more discretionary good, sales would drop to only 39 in this case.

So, with inflation, it’s easy to say you’ll increase prices by the inflation amount, but in practice, competition, and the type of good may not give you this leverage. Assess your product or business’ break even point here and model changes in sales price and cost of goods prices.

Cost Of Goods

Costs of goods are made up from the cost of physical goods, and/or the cost of direct labour that goes into your product or service. Can you negotiate improvements in the marginal cost of each unit or assess machinery or people efficiencies? Be careful though, that any improvement in input price may come at the expense in a commitment for greater volumes bought, which in itself has a risk attached, especially should inflation spur a wider downturn in the economy and therefore demand for your product.

Expenses

As mentioned, these are made up of items such as rent, wages, electricity, gas, computer equipment etc. Wages growth can both lead and lag inflation. For instance, inflation could be caused by wages growth – in which case you will see rises early in the costs of labour. It can also lag inflation – ie you may not see wage growth initially during times of higher inflation.

Bringing this all together, let’s build an example Profit and Loss and see the effects of the one of the inflation examples on this where maximum revenues can only increase by say 1%.

P and L Inflation Effect Base Model

P and L Inflation Effect Inflated Model

You can see that with company 2, revenues have increased by 3.66% in line with inflation as well as all input costs and expenses except wages. Wages are a little stickier in this example and we have them capped at a 2% increase. You will notice that the net profit drops from $53,000 to $32241 or net profit margin dropping from 5.3% which is relatively healthy, to a thinner 3.19%.

So, a rise in inflation, all things being equal, and even without a slowing of the economy, may cause a drop in your gross profit (in this case, of around 2%) and net profit (in this case by about 39%).

One secondary result also of the lower amount of your reserves being converted to cash in your balance sheet is again, the time value of money. You will likely have less cash reserves AND over time, the value of these will diminish – so what can you do..?

Business Options

Given this – what is your best course of action..? On the one hand, with increased inflation, the possibility of a wider economic downturn increases too – so, preserving cash may be a good option to ride out any tough times coming. But, the value of this cash will decrease too with increases in inflation.

Another option is to assess what efficiencies you can make, without hitting the overall capabilities of your business to service your clients. Can you purchase your direct physical goods any more favourably? Even shaving a $1 or two off of each unit may be a good strategy.

More likely, can you invest in your processes or other automation using cash efficient vehicles? So, you save on physical costs, but do risk higher debt servicing costs as interest rates are raised to combat inflationary effects by central banks. Here fixed options may be more worthwhile. Before you go down this route though, ensure that you assess your current and past asset turnover and return on asset ratios. You can get these in Jazoodle’s dashboard. Can you make your $s or £s work harder for your business? Can you improve your customers’ experiences of your business, and therefore longer term sustainability?

Long and Short term Debt (Liabilities)

With increasing inflation, and the likelihood of increasing interest rates, it would be worth examining your debt funding in place. Short term debt, you need to balance the need to preserve cash, with the paying down of this debt. Your Jazoodle Business Health Score will thank you for this! Can high cost debt be restructured into longer term, lower cost debt? Likewise, is your debt based upon variable interest rates? If so, assess fixing this at least in the short term

Conclusion

Inflationary pressures are building in many countries, brought about by both scarcity of supply as well as the effect of Government stimuli and of course labour shortages. Inflation will tend to reduce the worth of your cash over time, but will also likely lead to higher interest rates. It is likely that inflation will also erode your profitability over time, and therefore cash reserves available. Plan for preserving a reasonable cash runway, whilst not so much that the value of your cash reduces through the inflationary effect over the longer term. Assess efficiencies in your business, and renegotiate your debt funding should interest rates increase to control inflation. There’s much that can be done now, and businesses should consult with their accountant or business advisor to establish the best course of action for their individual business.

Andrew Paton-Smith is a co-founder and CEO of Jazoodle, and staunch advocate for small and medium business’ success.