Evolving Governance For Your Evolving Startup

Forward

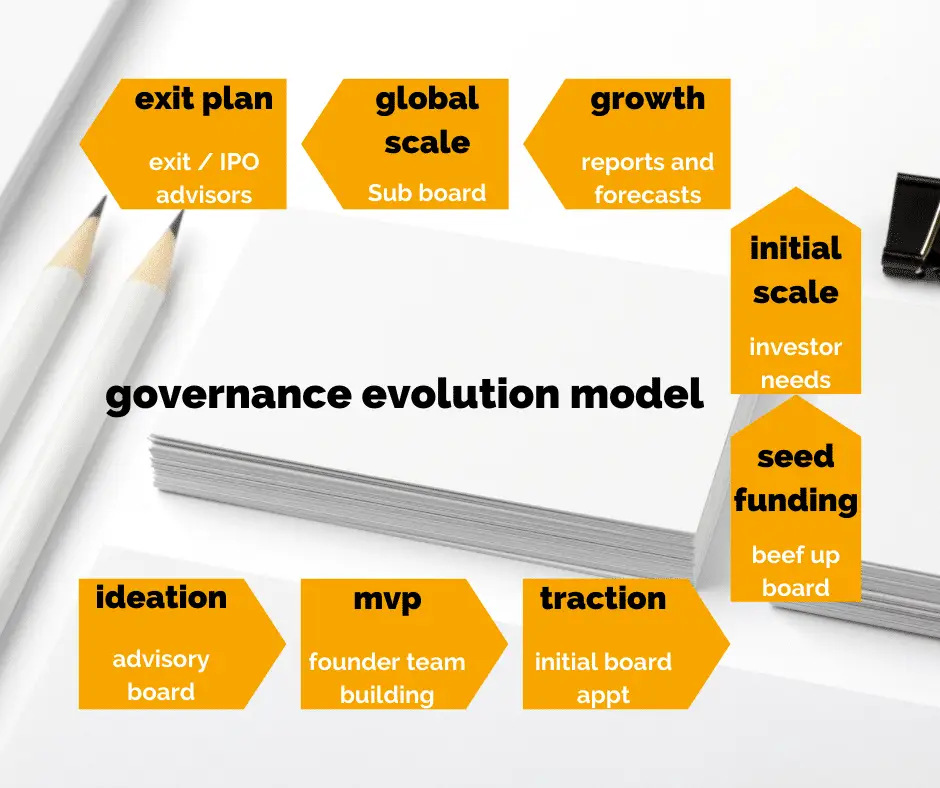

Companies, like people, evolve over time. As your startup grows, so will the mechanisms and processes in which it operates, in order to prosper. This is summarised on the below.

We are arguing, that strong governance of your startup is critical during all the stages of startup, however, the exact form of governance, the exact form of processes and board mechanisms will change as your business changes. Governance, should be seen as a living, evolving form. It follows a lifespan as does your startup. It should not be seen as being a static, but rather, a dynamic mechanism for founder and startup growth and ultimate success.

Outside of my startup adventures, I have witnessed some great, and not so great governance structures. The best ones evolve, grow, and scrutinise. As a tech startup founder, your business’ needs will change over time. Opportunities and threats/risks will emerge over time, that you may not have the skills to deal with appropriately. Managing the operational and executive side of your business will become a hindrance perhaps in identifying and sufficiently deal with these opportunities and threats

Idea Stage

When you start, possibly the only governance you will have in place is you, as sole director of your business. In Jazoodle’s early days, I was about to undertake a huge personal risk in getting my ideas off the ground. I was about to take decisions that would change my life forever, for better or worse. Whilst I didn’t have a formal board in place, except for me, I did know that I wanted by ideas, my decisions, my plans and assumptions about what I was about to do, challenged. I am a big advocate of challenging ideas, and saw no reason not to here! I assembled my first Advisory board . My idea was to challenge not only the idea, but also my business model, customer segments, provide advice in getting a product to market outside of the comfort of a multi million dollar budget!

As your ideas evolve, you’ll realise that your thoughts, ideas, and decisions need to be challenged. Another issue, and reason for bringing a group of experts together is this. As sole director, you are working primarily in your business; you’re the chief administrator, marketer, product manager, finance officer, and CEO. There’s an old saying, that if you are wearing too many hats, that at times, you are “not able to see the wood through the trees” This sums you up perfectly, and another great reason for assembling an advisory board in the idea stage. A group of people, that can help you see through the excitement, clutter, expectations.

One last word on boards v advisory boards. There is a very real difference between the two, both functionally, as well as legally.

An advisory board is a group of interested and trusted experts that come together, often voluntarily, in order to give your business additional advice, or guidance, or skills that you may be lacking. An advisory board, has no formal or legal powers to take decisions on behalf of a legal entity, such as a private limited company. Equally, members of an advisory board have no legal responsibilities as directors. Conversely, formal company directors are bound by companies legislation, which governs how directors must act, what they are responsible for, and invokes a legal liability on those individuals for the decisions (and omissions) that result from their directorship. In the early stages of startup life, the risk profile of your business is higher than probably at most other times of a business’ life, therefore, risk associated with being a formal director of a startup is also potentially huge personally, not to mention personal reputation. We’ve summarised the difference between an advisory board and formal board below.

One point to note, is that, just to complicate matters, formal and advisory boards are not mutually exclusive. An advisory board can and does often run in unison with a formal board. As a business grows, it often demands skills, knowledge and networks not available on the formal board. In this case, the formal board will often pass a resolution at a board meeting to assemble an advisory board, for a specific task or objective. The advisory board, becomes, in essence, an instrument of the formal board, and adds to the formal board’s capabilities.

Why governance is so important at all stages of a startup

As we have established, It is a legal requirement, under the various country’s company laws, that a formal board is established. This may be a single person, ie you in the early days, or a group of 3,5,7,9 as you grow and scale. Board’s form an important part of governance. Within companies, there are multiple stakeholders, each have interests in your company

A board is simply designed to ensure that you are largely meeting the needs of these stakeholders. A board is just a mechanism that is put into place to maximise shareholder (investor) value. It does this by setting strategic objectives that will both maximise financial value to shareholders which in doing so, manages risk appropriately, and therefore, ensures that all other stakeholders’ needs from your company are largely met. The board is the instrument that sits outside of normal day to day decisions of the business. The board sets the direction, and boundaries within which the management team carries out day to day decisions in executing that strategy. It is very important that as you grow, your board is not involved in the day to day machinations of your business. The ability to assess and act through strategic changes are a real strength to any founder or founding team.

Now, back to how this applies to startup evolution

MVP

As you start to build your ideas, you’ll need help, not just in bringing in additional skills and insights into your business, but as we have said, to ensure that an objective assessment is made of your plans, and that they fit with the strategic objectives set. With Jazoodle, we reached this stage when I needed to think about bringing in additional skills and ideas. I mean, launching a new product to market was going to stretch me way too far In the early days, you’ll probably have your co founders, or even family involved in some of the decisions that you need to make as a director of a startup. Within Jazoodle, we did this functionally, and appointed directors of technology, marketing, and operations – ie our co founders. Having said this, we had also just broken the first golden rule of board appointments, that of your board also being your day to day founders.

This is important. As we have said, boards need to sit above and objectively from the management team. We were a startup and therefore didn’t have the clout or the traction to entice a board outside of our business. In overcoming this, I also wanted to ensure that we had a “handbrake” on the board, and managed to approach and subsequently appoint an independent chairman, Trevor to chair our board.

I’d also hugely recommend that you run formal board meetings even at this stage. We ran monthly formal board meetings, within a set structure each time. The reasons we did this was to put into place a robustness for when we grew. Yes, it was probably a little over the top at our stage, but reflecting on this since, I’m glad we did. We have a rigidity and process we go through each meeting. Ensuring that the agenda is created and sent out at least 5 days before the meeting day and time. Ensuring that we have a strong set of agenda items that was flexible, but followed a consistent path. See recommended board meeting agenda.

It’s worth pointing out that a key part of your board agendas are to ensure that the objectives that have been set at the board, are largely on course of being achieved. You do this by being obsessive about your business numbers. Again, it is highly recommended to get into the habit of presenting your numbers, or metrics that matter early and refine them as you evolve. With numbers, I don’t just mean presenting your profit and loss, cash statement and balance sheet. To many of your initial board, as well as in the early days, they will be meaningless. Think about two levels of numbers. The things that drive the success of your business at the first level. Such as number of customers acquired, cost of acquisition, your cash runway etc. But also think about the strategic numbers, such as earnings indicators, costs indicators, efficiency indicators and asset returns indicators. This is a great habit to get into early and as you scale, you’ll have the systems and processes in place ready to meet the demands of scale and formal, independent boards.

Early traction and scale up

As you grow, and revenues start to build, you will need to think even more about the second level of numbers. At a higher, strategic level, your business health, your returns on investment, solvency, liquidity, how well your assets are working for you as they grow start to become more important. Jazoodle does this quickly and simply when connected to Xero. Your board will want to ensure that as you start your growth path, that financial risks are identified early, that your funding structure is right for your business and growth plans. That you are on the right path financially to hit your targets.

Investor Readiness

Now, this is where things become more serious for you and your board. I won’t go into the ins and outs of securing funding, however, will touch upon the need for you and your board to be acutely aware of the numbers within your business. There are two main aspects to this, 1) the due diligence required by the funder in making sure that your business is sound, has no skeletons in the cupboard, and the assumptions that you have made about your potential growth are valid and risks acknowledged. 2) Once funding is secured, ensuring that you are tracking growth and projections painlessly where possible.

Let’s look at the first of these, due diligence. This by no means confines itself to your financial numbers, so be aware to bare your soul and make available all information that is likely to impact risk within your business. This is commonly called putting together a data room. Your Financial data room should of course contain financial reports from your accounting system – such as Xero, along with other pertinent information that can highlight potential risk or exposure. Having a performance dashboard and scenarios ready is also a good move and in some respects, will give comfort to the potential investor of the steps you have in place to manage financial risk and future scenarios.

The second aspect is that of, once funding has been secured, ensuring that you keep your investors and board abreast of how your business is tracking against its objectives. Often, a funder will insist on having at least one representative of the institution on your board. The big problem with supplying only financial statements as part of your CEO financial update is that of not summarising information succinctly or gathering it efficiently, to then transform it into meaningful data for your board.

It is after this stage, that you will often need to expand your board, or even change your board members. It is likely, depending upon the investor, that a representative of the investor will require a seat at your board. Depending upon whom is nominated, this could be a real bonus for your business, but also increase responsibilities in what you will produce at board meetings. It is also noted, that at this time, it is worth having a skills assessment in order to ensure that your board will bring maximum value to your business as it grows. Try not to settle for convenience, but have an objective view as to what you need your board to look like as you move into unknown areas. How will their skills, personality, and networks fit strategically with your vision? Board composition best practice also suggests that as you grow, bring in independent directors, who can act with full scrutiny into your direction and how you execute that direction. As you grow further still, consider a board of perhaps up to 3 independent directors, along with your other nominated directors.

Exit Planning

As your business scales yet further, your board may likely need expanding, or new skills brought in. There could be the likelihood of a future exit on the horizon, either through purchase or iPO. It is also likely that those skills being brought onto your board, may not be financially literate. Building upon the successes of the tools you utilised in the early days, you may need to not only report strategic performance, but also assess likely valuation of your business. There is also often, a mental gap between what you think your business may be worth, and what a potential purchaser or investment banker may think its worth. You may need to model scenarios not only of future performance, but also how this will impact your likely valuation and therefore exit. Having the ability to do so live could be a major benefit to you and your board, so that you can model further assumptions, financial structure models, capital investment decisions, and revenue and cost changes quickly.

Summary

Thinking about governance and board structures even in the very early days of your startup journey is, we believe, critical, to ensuring future readiness to dominate the world! We’ve highlighted why boards exist, and also the differences between an advisory board and formal board. The diversity of thinking that both advisory and formal boards bring can be an enormous benefit to your startup. However, with that diversity, brings a requirement for ensuring that you, as founder are able to succinctly highlight risks and opportunities to all stakeholders. Doing so quickly, efficiently and as importantly, with trustworthiness is critical to your journey, and your education as an entrepreneur. Get into good habits early, keep improving them and evolve them as your journey evolves.